STEM education, college preparation

24-25 SY Open Enrollment begins November 1 2023!

We are an A-rated free, K-12 public charter school with a very involved and supportive parent community. Our focus is on STEM and college-prep.

Paragon Science Academy ranked #12 in the Phoenix Metro area of the U.S. News and World Report 2022 Best High School annual rankings; ranked # 18 in Arizona’s Best High Schools; and # 169 nationally for charter high schools.

Paragon Science Academy ranked #6 Arizona’s Best Charter Elementary School and #35 in all Arizona Elementary Schools by U.S. News and World Report, 2021.

Paragon Science Academy ranked #7 Arizona’s Best Charter Middle School and #20 in all Arizona Middle Schools by U.S. News and World Report, 2021.

2023 Arizona Science Olympiad State Champions

1:1

Technology

100%

Students Learn Coding

100%

Graduation Rate (2022)

STEM Champions in Chandler

Sonoran Science Academy provides a rigorous, college prep, STEM-focused education through a challenging, comprehensive curriculum, continuous assessment, and dedicated teachers,inspiring students to become the leaders of tomorrow.

Learn more at a school information session

Learn more about our school at a School Information Session! You’ll meet our principal, learn about the school, and find answers at a Q&A session.

For families with younger students who are entering into kindergarten, we invite you to join us for Kindergarten Readiness Sessions for students .

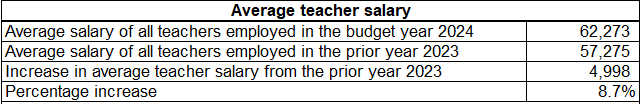

Average Teacher Salaries

Be a Superhero To Our Schools

Support Our Students

Donations can range from monetary donations, to specific items (e.g. science equipment; playground equipment), to tax credit contributions.